Highlights from Holm Truths

Over the next few weeks, this column will run highlights from Mary Holm’s quarterly newsletter Holm Truths. Mary’s regular Q&A column will resume on October 27.

MORTGAGE MOVES

You’ve probably got the message by now: It’s a great idea to pay off your mortgage as fast as possible.

Paying off a 9 per cent mortgage, for example, is equivalent to making an investment that pays you a guaranteed return of 9 per cent after fees and taxes. And it’s risk-free.

But not everyone is in a position to pay extra off their mortgage. There are other ways you can make the big loans work better for you. Here are some FAQs:

QShould I add high-interest debt to my mortgage?

AIn most cases, yes.

For a start, it makes life easier to put all your debts together, so you have just one payment to deal with.

And adding credit card and hire purchase debt to your mortgage is certainly better than taking up other debt consolidation offers that sometimes charge interest as high as — if not higher than — credit cards.

The big advantage of adding your debt to your mortgage is, of course, that you pay lower interest.

But there are two disadvantages:

- You may have to pay early-repayment charges on the other debts. Make sure your interest savings will more than make up for that.

- Unless you take steps to avoid it, you turn short-term debt into long-term debt. By repaying the money over a longer period, you can end up paying more total interest despite the lower rate.

The trick is to continue to pay off the same amount as you would have paid on the high-interest debt, in addition to your regular mortgage payments.

That way, you will get rid of the debt faster and end up with a genuine interest saving.

While we’re at it, try not to take on any more high-interest debt. If you save for items before buying them you will end up much better off.

QIs it better to make mortgage payments fortnightly or monthly?

ALenders sometimes claim that you save lots by paying half the monthly amount each fortnight.

But that’s mainly because you will make 26 half payments a year, which totals 13 full payments instead of 12. In other words, you are simply paying off the loan faster, so of course you will pay less interest.

You could achieve the same result by boosting your monthly payments by one-twelfth.

This, however, ignores the real issue. It’s best to match the frequency of your mortgage payments to the frequency of your salary or wage payments. Have the money transferred to your mortgage the day after you receive it.

There are two advantages to this: You’re not tempted to spend the money on something else. And the money doesn’t sit around in a bank account earning no or low interest, which is taxable. Once the money is in the mortgage account, that’s the equivalent of earning you the mortgage interest rate, free of tax!

Footnote: If you are paid weekly, the mortgage lender might not accept weekly mortgage payments. You should opt for the closest to weekly, which will probably be fortnightly payments.

QIs a no-deposit mortgage a good idea?

AMost people probably shouldn’t take on a mortgage if they can’t save at least a few thousand dollars for a deposit on a home.

Don’t rely on a keen mortgage lender to assess your ability to service a loan. Make sure that you won’t find yourself unable to meet mortgage payments and having to sell your house at a time that doesn’t suit you.

If you do face a forced sale, you are not in a strong position to bargain. If it happens to be when house prices have fallen, in particular, you may well end up owing the bank more than you get for your house — possibly leading to bankruptcy. It’s happened before and it will happen again.

Another negative is that 100 per cent mortgages usually include lender’s mortgage insurance, which can raise the fees considerably. And the insurance protects the lender, not you.

A safer way is to find out, before you buy, roughly how much mortgage payments would be on the sort of house you might buy.

If it’s, say, $1300 a month, and your rent is $600 a month, save the $700 difference for a year or two, and then use that money as your deposit. Then you will know you can probably cope with the mortgage.

QWhat should I do if I just can’t meet new higher payments when interest rates rise?

AAn obvious answer is to reduce your other expenses. If you keep track of all your spending for a month or two you may find areas in which you can cut back. In some households, though, that’s easier said than done.

Another solution is to negotiate with the lender to keep your payments at the old lower level and extend the term of the mortgage.

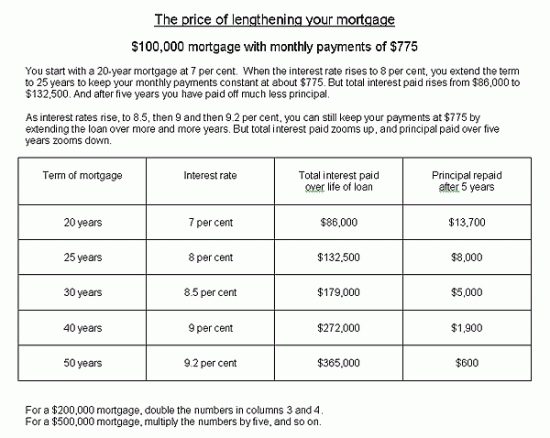

Let’s say you’ve had a $100,000 20-year loan, fixed at 7 per cent some time ago. Monthly payments are $775. If your mortgage rate rises to 8 per cent, you can keep your payments constant at $775 by extending the loan to 25 years, as our table shows.

And if rates rise to 9 per cent, you can still keep paying $775 a month if you extend the loan to 40 years.

There’s a big downside though. At 8 per cent, over the life of the loan you will pay more than 50 per cent extra in interest And at 9 per cent, you will pay more than three times as much interest.

Of course, most people won’t own the same home for 20 years, let alone 40 years. But you’ll still be paying much higher interest for the period in which you do own the home.

There’s another point too, which is particularly relevant if you own your home for a relatively short period.

The longer the term of the loan, the smaller the proportion of your early mortgage payments that will go towards reducing the principal.

In our example, with a 20-year loan, after five years you will have paid off $13,700. But with a 40-year loan, you will have paid off a mere $1,900. And with a 50-year loan, you will have made only a $600 dent.

If you do extend the term of your loan, it’s a great idea to reduce the term again later, whenever your income rises of mortgage interest rates fall.

IT’S NOT A RIPOFF

Let’s say you can’t afford your mortgage payments so you extend the term of your loan. You end up paying more total interest.

But you are not necessarily being ripped off.

Interest is the price you pay for using someone else’s money. If you use it for longer, it’s fair enough that you pay more for it.

However, it’s a good idea to be aware of the interest cost of these moves. The more years you spend paying interest to others, the fewer years you have to accumulate savings for yourself — at which point you will be the one earning interest or other returns.

TOO INTERESTING?

Some lenders offer interest-only mortgages. Keep in mind, though, that you will never pay off the principal (the amount borrowed).

And you might be surprised at how little extra you would have to pay each month to make inroads into the loan.

On a $200,000 interest-only mortgage at 8 per cent, you would pay $1,333 a month.

But if you were instead repaying principal and interest over 30 years, you would pay $1,468 a month — just 10 per cent more. And for that small extra amount, after 30 years you would own the house mortgage-free.

No paywalls or ads — just generous people like you. All Kiwis deserve accurate, unbiased financial guidance. So let’s keep it free. Can you help? Every bit makes a difference.

Mary Holm is a freelance journalist, a director of Financial Services Complaints Ltd (FSCL), a seminar presenter and a bestselling author on personal finance. From 2011 to 2019 she was a founding director of the Financial Markets Authority. Her opinions are personal, and do not reflect the position of any organisation in which she holds office. Mary’s advice is of a general nature, and she is not responsible for any loss that any reader may suffer from following it. Send questions to [email protected] or click here. Letters should not exceed 200 words. We won’t publish your name. Please provide a (preferably daytime) phone number. Unfortunately, Mary cannot answer all questions, correspond directly with readers, or give financial advice.